Staying Rational During a Pandemic: Join Dan Ariely Live on Instagram @Qapital

●10 Apr, 2020

What’s the smartest way to spend my government stimulus check?

|

April happens to be Financial Literacy Month, and this year coincides with a financial crossroad for many of us. The spread of the COVID-19 (coronavirus) pandemic has impacted nearly every American, with 75% of the population under “Stay at Home” or “Shelter in Place” orders, and more than 16 million Americans filing for unemployment since the onset of the crisis. Meanwhile, many are fortunate to be working from home, but they have to juggle childcare and home maintenance on top of their usual workload and stress.

Living through this pandemic is a recipe for making irrational decisions - and that’s why we enlisted our Chief Behavioral Economist, Dan Ariely, for a series of Instagram Live sessions on @Qapital. If you aren’t following us yet, this is a good time to do so.

Each session will deal with a different way COVID-19 has the potential to make us act irrationally, and how to curb those urges. If you’ve got a question for Dan, tell us on Instagram or reach out to Dan directly via Twitter.

No time to watch? Loved it, but want a refresher?

Watch this space as we summarize the most important takeaways from each live session.

Session 1: April 16, 2020 12:30 PM ET

Watch Recording >

Our mindset these days can be characterized as one of learned helplessness. We feel as though we have no control over the situation, and no ability to anticipate what will happen next. There are 3 financial behaviors we may choose to deal with this:

- Shopping therapy - This is one of the most effective ways to momentarily regain a sense of control over the world; we covet something and make it our own. However, this is not a good way to deal with the uncertainty we feel, since not only is it expensive, it is likely to only aggravate our worries, which are largely financial to begin with.

- Plan for a rainy day - This includes taking select steps to gain some control, such as starting an emergency savings fund. While a savings fund started today may not be helpful in the current crisis, it is nevertheless reassuring to know we are taking steps that will enable us to have some control over an uncertain future.

- Curb spending - If you're sitting at home, feeling guilty for doing some late night online shopping, you're not alone. "Life is not about being miserable, life is about using our resources the best way possible", says Dan. If you're unsure whether something fits in your budget, try to hold off on making the decision to purchase it until Monday. Why Monday? According to an experiment Dan and his team ran with Qapital users, weekly budgets that were reset on Mondays seemed to yield the best results.

Beyond the future of our money, the state of the world has many of us worried. From a behavioral economics standpoint, here are Dan's recommendations for reducing stress these days:

- Control your media habits - Media coverage of COVID19 (coronavirus) has naturally stirred anxiety among audiences. Several times a day, on multiple media, we're hearing of people getting sick and dying. This in turn creates the urge to check the stats over and over again. In the very least, try to avoid doing this first thing in the morning or last thing at night.

- Don't obsessively track the stock market - As global economies deal with this pandemic, stock markets worldwide will continue to be volatile. In this climate, it can feel necessary to consume as much information as possible in order to stay 'a step ahead' of the market - but this is virtually impossible. This behavior is much more likely to result in worsening your anxiety.

- Leverage your time and flexibility - For many of us living through this complex time, social distancing means more free time, whether that's time saved on a commute or time typically spent socializing. If we wanted to invest all this newfound free time in ourselves, how could we best use it? Think about developing better habits.

Dan received numerous questions both before and throughout the live recording, of which he was able to answer the following.

Are there types of savings goals I should be prioritizing now?

According to Dan, if you don't have a rainy day fund, the current state of the world has proved we all need one. Beyond this, think of goals in both short and long terms. Larger, long term savings such as home down payments are great, but they aren't very motivating day-to-day because their achievement is a long way ahead. "We need to create a life that has some happiness and fun in the short term, too", says Dan. So consider that a 'yes!' vote to your dilemma about whether or not to save for that new laptop you had your eye on.

Should I be investing now as a beginner, or should I wait?

Nobody knows how the market will behave, and it's hard to predict it. However, if you always wait for the right moment, you may never start. Dan recommends the cost-base-average approach: if you're unsure when the best time is to start, just start. Create a habit and put money into the market every month, such as with a Qapital Invest account with a regular deposit. In the long term, you'll never hit the exact best point to invest, but you'll get in the habit and you'll have bought at an average price that likely isn't the worst, either.

What's the smartest way to use my stimulus check if I don't need it to make ends meet?

There are two ways you could choose to use it that would be considered 'smartest', according to Dan. First, consider - how much would you need to have in your emergency fund to feel secure? If the figure you came up with is equal to or lower than the sum you already have saved up for a rainy day, then your best bet is probably to invest it. However, if you would rest easier at night knowing that money was in your savings, then that's where it should go. Sure, it may not be as beneficial financially in the long term as investing, but "it's worth your psychological peace of mind", suggests Dan.

I'm lucky to have a job, but my pay was cut 20%. How should I adjust my budget?

20% is a big cut. You can't simply cut your budget by 20% - your mortgage/rent, electricity, etc can't be readjusted that way. You'll need to readjust other things. "This is an opportunity to reexamine what are the things that give us joy", urges Dan, prompting listeners to take a look at their expenses and determine which of them actually bring them happiness. Then, take on the challenge to create a new budget under the new constraints.

What financial goals do people find most motivating during the COVID19 crisis?

While some of the goals were discussed above, including safety (emergency funds), and some short term goals to stay on track, Dan had another message to round out the session. "We all need something to look forward to. We should all create some kind of goal to look forward to. And maybe it doesn't have a date, but we need to get some goal, some aspiration to work toward."

Session 2: April 23, 2020 12:30 PM ET

Watch Recording >

Thinking about money during the COVID19 pandemic is unavoidable. Money is the common good, the thing we can exchange for anything else, from apples to cars and vacations. But it's also important to remember that money is all about opportunity cost, meaning it's essential to think about what we're giving up each time we choose to spend it.

That's easier said than done. When was the last time you bought something and thought - 'for what I'm spending on this, I can buy something else?' You probably haven't, for both small and large purchases alike. To illustrate, Dan's research team held an experiment in a car dealership, asking people about to buy a new car, to specify what they'll be giving up by making the decision to spend money this way. The most common answer they gave was that if they buy this brand of car, which happened to be Toyota, they can't buy another brand of car. While that's true, people did not seem able to wrap their minds around the fact they'd also be giving up the opportunity to spend the same money in countless other ways, from cups of coffee to groceries and even stocks.

Thinking about opportunity cost is hard enough, and technology actually makes it harder. Amazing technologies like mortgages and credit cards make it harder for us to realize the consequences of our actions. Without these mechanisms, for instance if you had $50 cash to spend per day, you'd quickly understand opportunity cost - if you spend too much on breakfast, you'll have less money to spend on lunch and dinner.

The answer to overcoming the challenges posed by technology in realizing opportunity cost, is budgeting. "A budget can help us, as it basically restricts our thoughts to a domain", explains Dan. "If we were all rational, we wouldn't need to budget, because we'd know the optimal use for each dollar. Budgets assume we're irrational. They create a boundary for spending. But boundaries have a cost," pivots Dan, talking about the tediousness of setting, monitoring and sticking to a budget.

"If you have to count calories on everything, life is not worth living. Pure budgeting, like pure calorie counting, is miserable. We're not here to suffer, we're here to enjoy - within constraints."

The answer to avoiding the pain of budgeting is twofold:

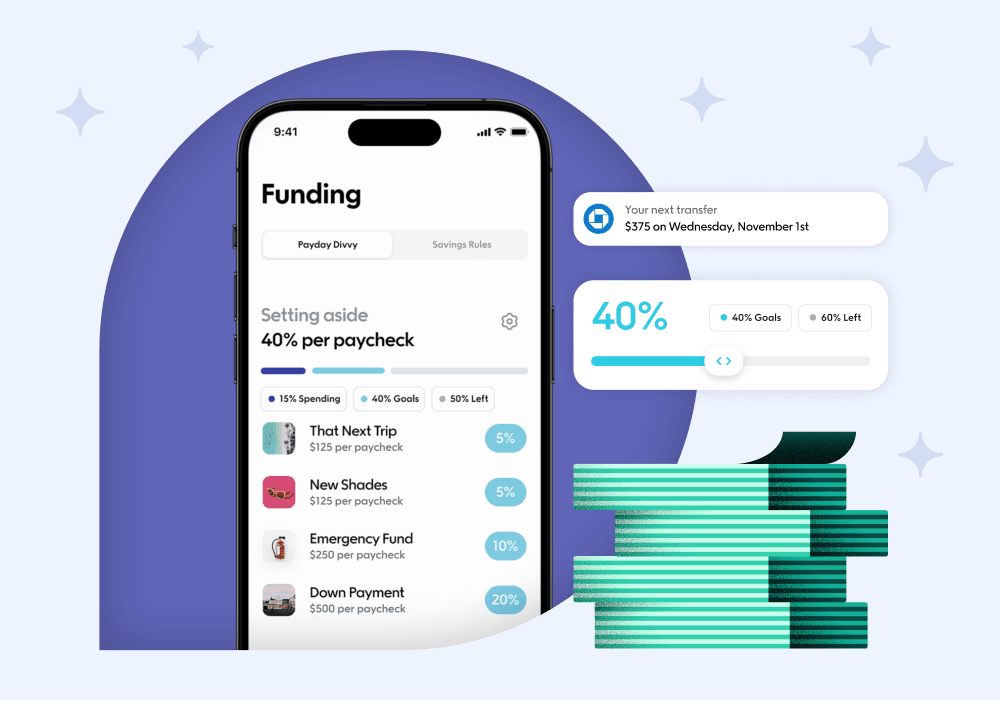

- Go meta: Instead of drilling down your budget to multiple categories, keep things broader and have an aim for what you want to spend. "That's what we did at Qapital with the Spending Sweet Spot", describes Dan, referring to our monthly budgeting tool that helps users stick to a realistic budget they're comfortable with, allowing maximum discretion for what to spend on and instead focusing on the bottom line, the amount spent. This approach works for both short term and long term goals, since it forces us to look at opportunity cost - what is more important to us at any given time - and decide the course of action.

- Automate what you can: By moving money away automatically, you increase the likelihood you'll be aware of opportunity cost by not mistakenly assessing your financial situation based on the amount you see in your checking account. If, for instance, you get paid on the 1st of the month, but your rent is due on the 10th, having a significant surplus in your checking account for the interim can cause you to make bad decisions. Moving money away into buckets - for instance, various savings Goals in your Qapital app - keeps you accountable, and more aware of the tradeoff that happens every time you choose to spend money.

But the benefits of budgets go even further. "Budgets are supposed to help us have a plan for our lives", determines Dan. This plan is meant to help us make a choice between spending now, or spending later ('spending later' is really just another way to think about savings): "Goals are a concrete way to take the thing we want to spend on and [putting] it front and center." Conversely, if you have loosely defined goals, you'll end up taking other people's goals - such as going to the supermarket without a list, and ending up buying everything the supermarket wanted you to buy. We all need concrete, clear goals to serve as an action plan, in everything from a grocery run, to our summer vacation, and our eventual retirement.

By having a plan, it makes it possible to recognize deviations, and even actively decide to deviate from the plan. Imagine the money in your checking account was already pre-allocated to certain goals, making the opportunity cost clearer. The money is 'spoken for', so if you want to deviate from the original plan, you'll need to decide what is more important to you.

Setting up goals and automating deposits is not easy, and neither is spending money rationally or thinking about opportunity cost. We need mechanisms like budgets and automated paycheck allocation to think in a deeper way about money, and realize it's all about tradeoffs.

With that said, what's the best way to spend some money these days, assuming you have some to spare?

"It turns out that giving gives us a lot of joy. Buying things for somebody else makes us happier than buying things for ourselves."

Session 3: April 30, 2020 10:30 AM ET

As some states make the controversial choice to reopen in the face of the COVID-19 pandemic, many are wondering what life will look like post-social distancing. Which behaviors will stay with us after stay at home orders are lifted? Which will go away?

For this discussion, Professor Ariely referenced 3 distinct time periods:

- Pre-"corona days": Characterized by a range of social activities available to us, from going to coffee shops and movies to meeting friends regularly and working from offices. Traveling, socializing and discretionary spending were key components of many of our lives.

- "Corona days": The time period we're currently living, characterized by dramatically limited activities and restricted mobility. "As you can see, I didn't get a haircut for a while", Dan joked. Now that we're restricted in many of the habits and behaviors that used to bring us joy in the pre-period, "we can suddenly ask ourselves: how much of it is good, and how much of it is bad?" Many of us are finding new sources of joy, whether it's cooking, drinking a glass of wine at night, or gardening.

- Post-"corona days": This time period can be divided into two. The first may be imminent, and is the gradual lifting of restrictions by the government. The second will be one or two years down the line, when the virus is no longer a significant threat.

So, are we resigned to a period of anxiety once society reopens?

"Corona fear", as Dan refers to it, is very real. "I see people on Netflix hugging and I think, what are you doing?!" Seeing the number of infections and deaths gradually go down is not going to be enough to reduce these fears, nor to break the habits we formed during 'corona days' - and neither of those will happen overnight.

These days, many of us have less organized work lives, resulting in things like waking up later and staying up later than usual, privately multi-tasking on a screen during meetings, etc. As states are allowed to reopen, many of these habits will naturally and gradually be shed, replaced with our old habits which will feel uncomfortable at first and then natural. "This has to do with how we learn from experience", Dan explained. Nowadays, we may be afraid at the thought of certain activities, such as going to the supermarket where we might bump into someone or touch something contaminated with the virus, or even going back to an office setting where we'll sit in close proximity to coworkers.

"As things open up, we will experience those, and to a large degree, nothing bad will happen." Picture, if you will, your first week back at the office. You're called into a meeting and the room is just a bit too full to your liking. You feel uncomfortable, but you stay. And to your amazement, nothing bad happens. Same with the supermarket - you'll take precautions, but one day you'll let your guard down for a brief second and get too close to a stranger, or touch your face right after touching the register. And again, most likely nothing bad will happen. Slowly but surely, we'll be less afraid of going to the office or supermarket.

But there's another set of habits that Prof Ariely predicts won't return quite so seamlessly. "This model will only work for the things we have to do, it's not going to work for the things we don't have to do." For example, coffee shops will need to deal with the very low odds that people are going to want to come in and sit in close proximity to strangers, while drinking from cups they know have been used by others. The answer, according to Dan, is to design a coffee shop that is tailored for the period of ramp-up soon after reopening. For example, coffee shops can initially space seating widely and use disposable cups, then gradually as patrons become more comfortable with the idea of coffee shops again, increase density. This would ease people back in to the habits they once cherished. "Maybe it's not the ideal coffee shop, but it's a coffee shop", concludes Prof Ariely.

If coffee shops choose this route, they'll increase the likelihood that at least some people opt to visit them again in their new "format", guaranteeing that they'll allocate time for them, and thereby decreasing the likelihood of a new habit taking the place of loyal coffee shop lovers. When it comes to businesses that depend on close social proximity, such as organized sports, they have an even greater challenge. If we have no sporting events for the next two years and then come back, will people show up all of a sudden? Not necessarily. "If you're a fan of a particular team right now, and you really care about them, in two years your time will have been consumed by something else." Dan's advice to sports organizations is therefore to find an activity to retain fans' passion and interest during this time.

"Create an activity that is intermittent; I'm hoping that cities will think about think about these intermittent institutions - like movies, and music, and lectures, and coffee shops - that give cities the flavor and joy we all used to have."

The materials and content discussed in these sessions and on the Qapital app and website are opinions for informational and educational purposes only and are not intended to be tax, personal financial planning, investment or financial advice. Please consult a licensed qualified professional about your personal situation.

Share