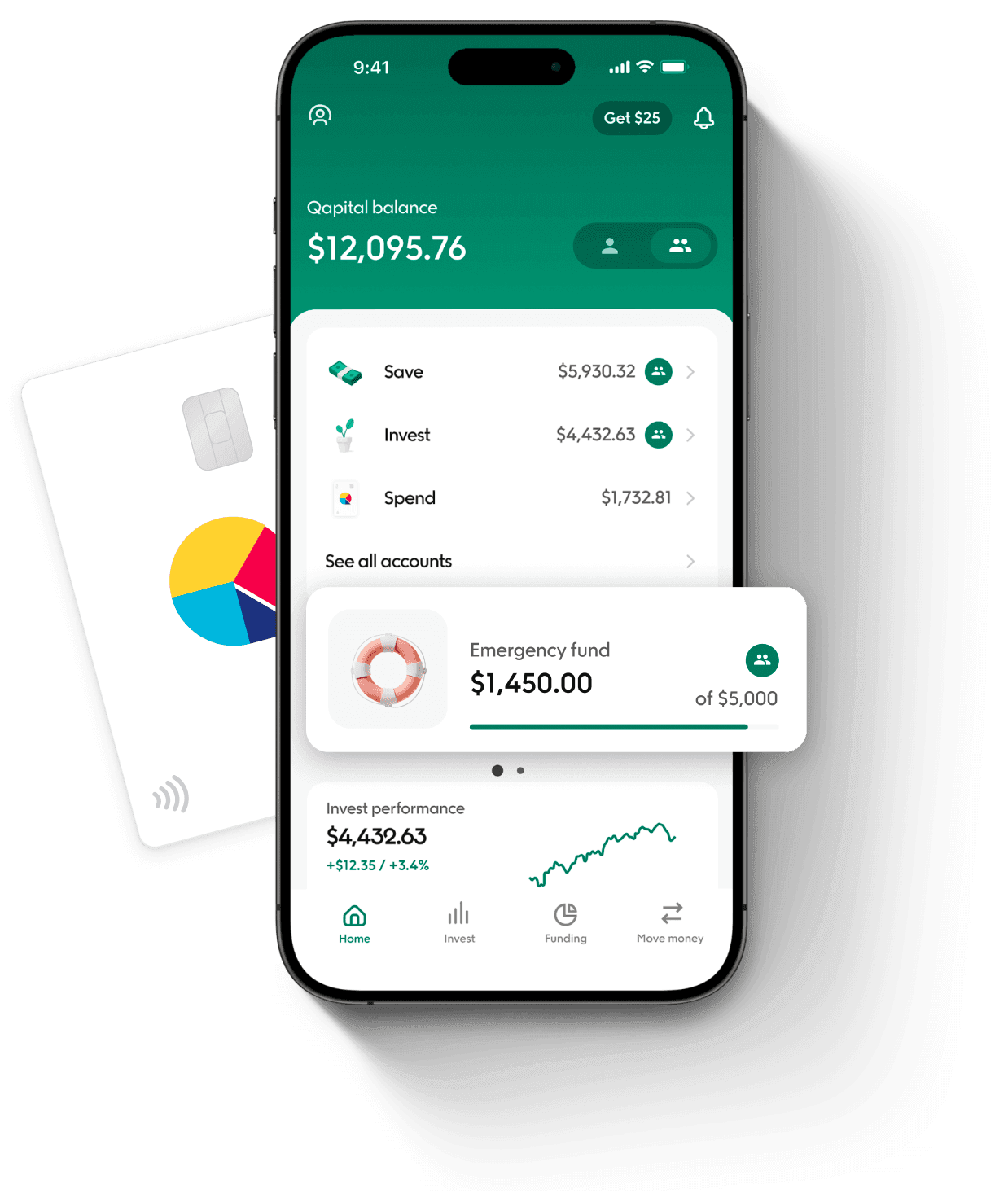

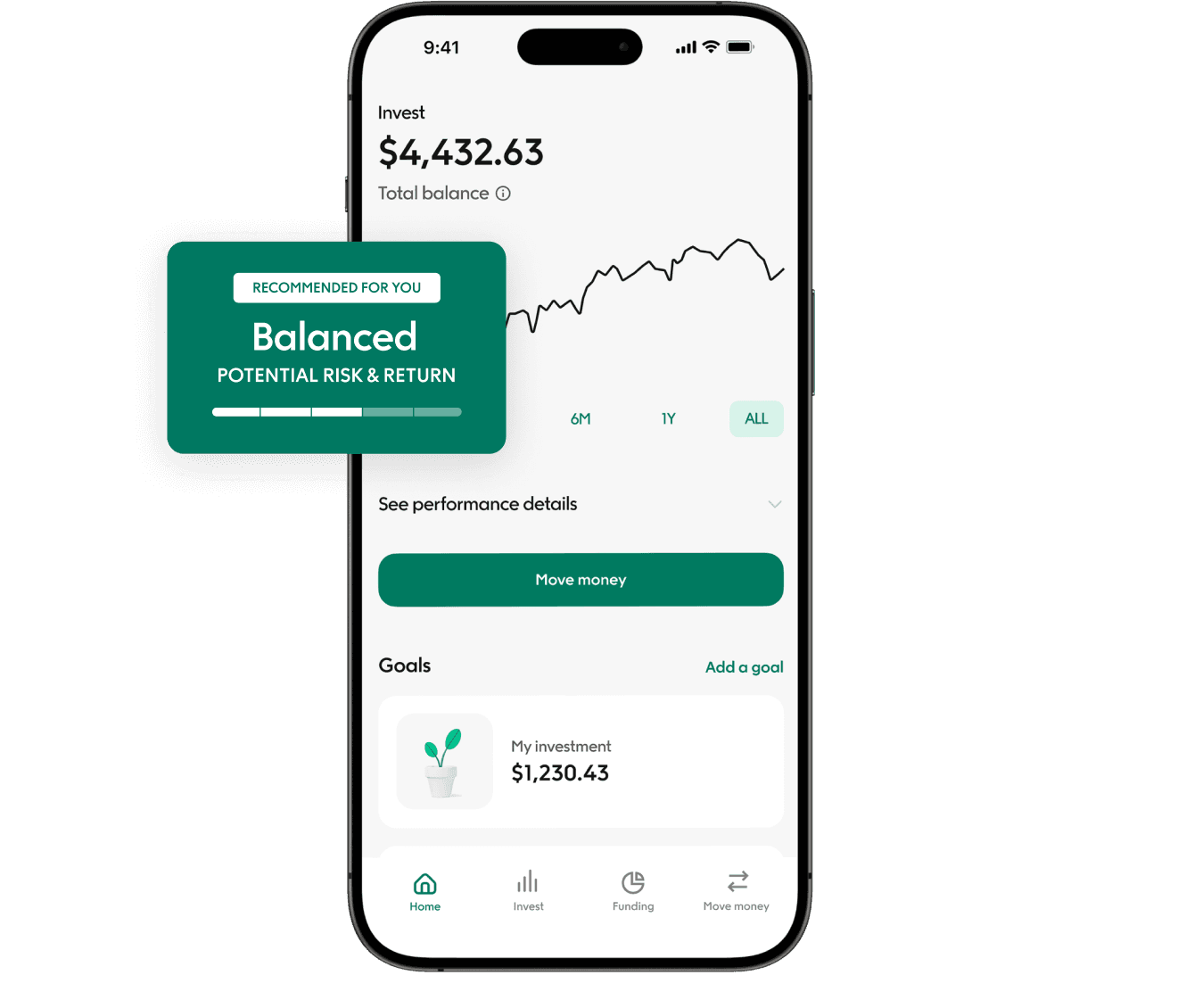

Sit back, relax and invest

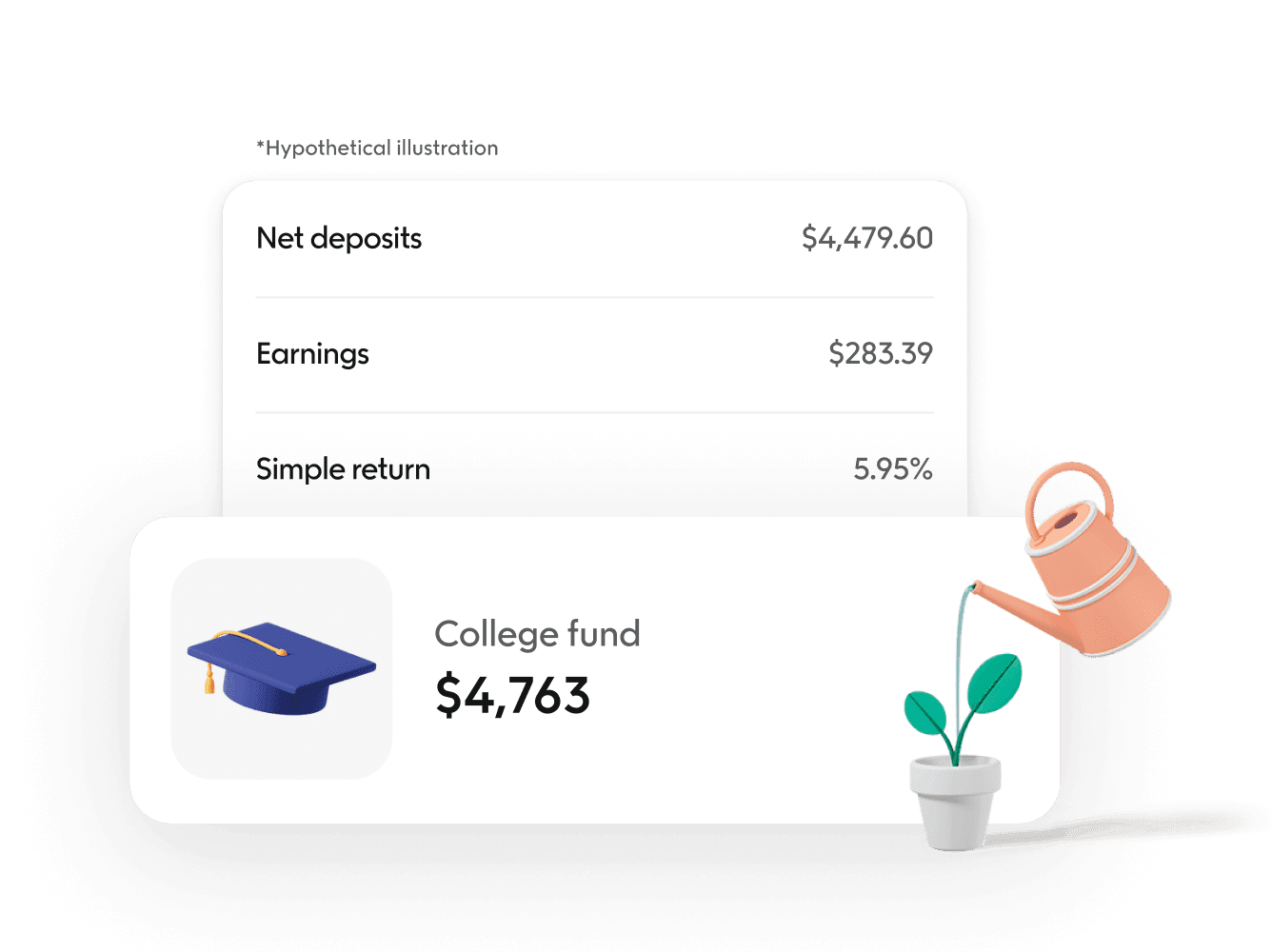

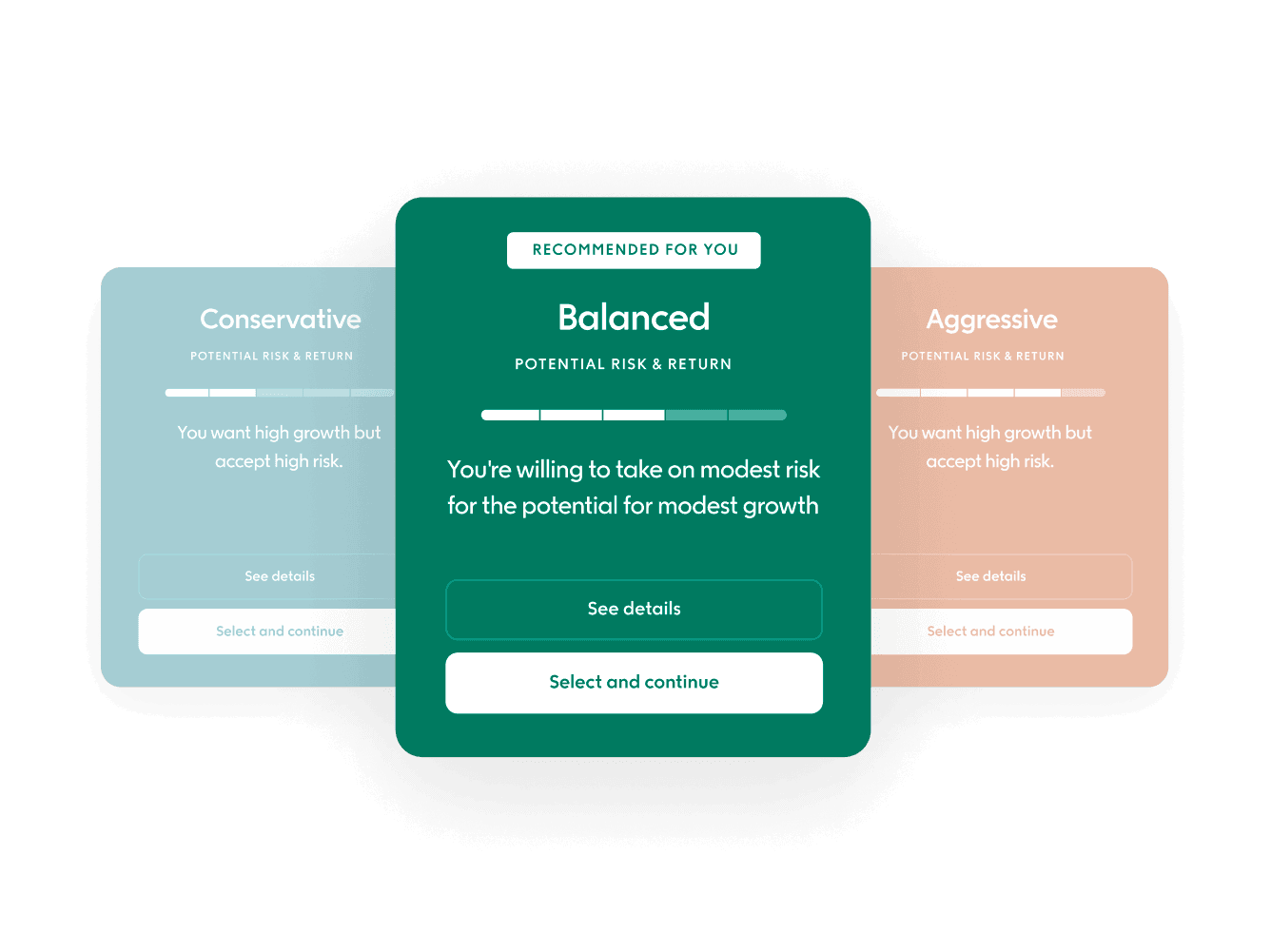

Set yourself up for the future with a ready-made investment plan that fits just right.

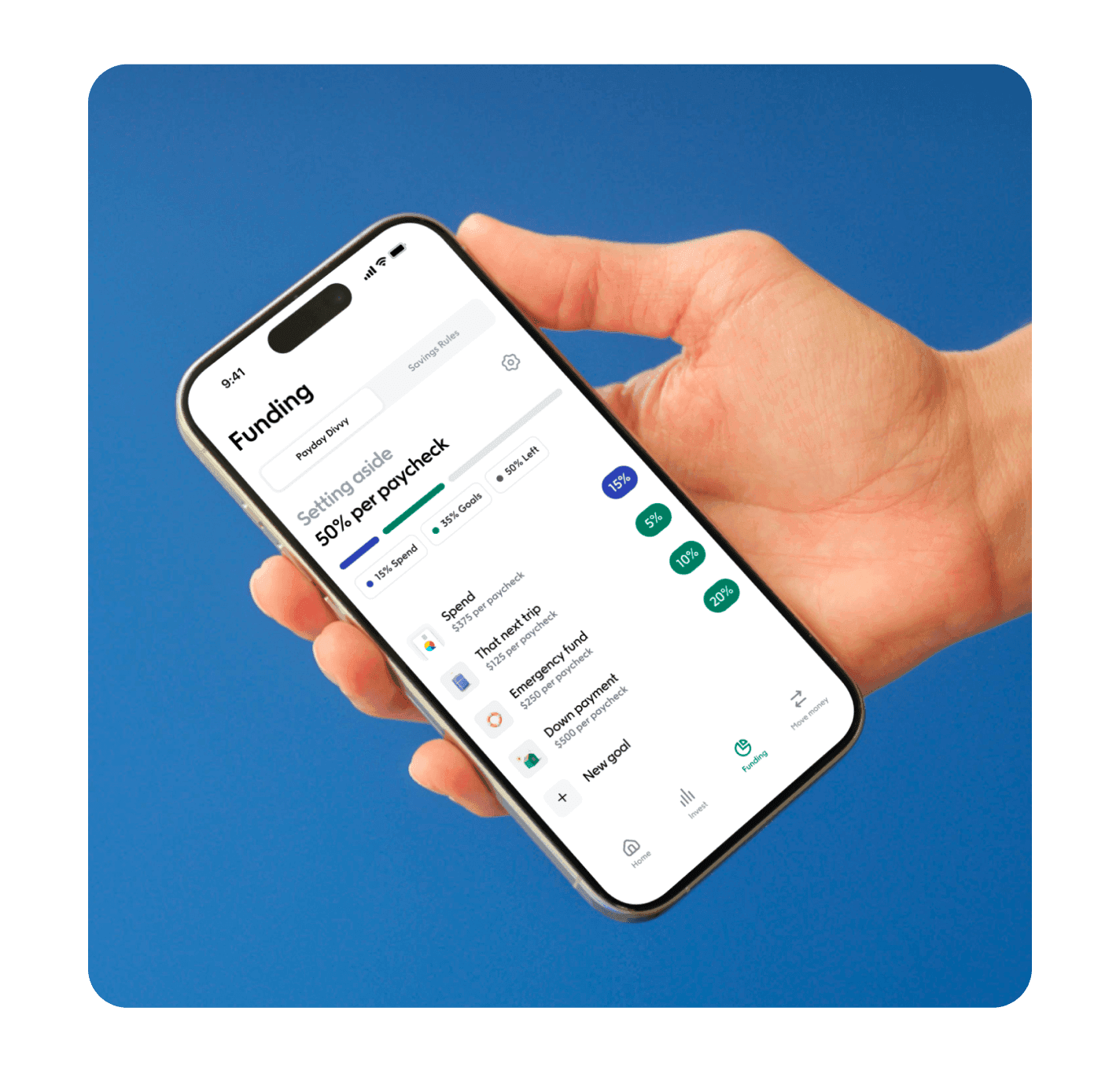

Start moving toward your long-term goals in minutes

Do whatever’s comfortable for you

Add money automatically while you live your life

Simple, safe, secure

SIPC-insured brokerage partners

Best-in-class ID verification

Honest pricing, no hidden fees

The not-so-small print

Advisory services provided by Qapital Invest, LLC, an SEC-registered investment advisor. Brokerage services provided to Qapital Invest clients by either (i) Apex Clearing Corporation, an SEC-registered broker-dealer and member FINRA/SIPC or (ii) Wedbush Securities Inc., an SEC-registered broker-dealer and member FINRA/SIPC.

Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are hypothetical in nature and may not reflect actual future performance. This is not a complete description of Qapital Invest’s investment advisory services. For more details, click here. Brokerage services provided to Qapital Invest clients by either (i) Apex Clearing Corporation, an SEC-registered broker-dealer and member FINRA/SIPC or (ii) Wedbush Securities Inc., an SEC-registered broker-dealer and member FINRA/SIPC.

Contact: 169 Madison Ave, #2002, New York, NY 10016. Email: support@qapitalinvest.com

IAPD provide information on Investment Adviser firms regulated by the SEC and/or state securities regulators. adviserinfo.sec.gov

Start your free trial

Qapital costs $0 for 30 days.* After that, it’s about the same price as a cup of coffee.