We’re here to help you fund your best life. Effortlessly.

What if managing money wasn’t so hard?

Hi, we’re team Qapital. We’re on a mission to make money management not just easier, but a natural part of your daily life.

Our journey began with two simple questions: why is managing money so challenging for people and how can we help? Studying behavioral economics taught us that humans are simply not wired to process tradeoffs between spending now and saving for later. So our efforts commonly lead to frustration, stress, and altogether avoidance.

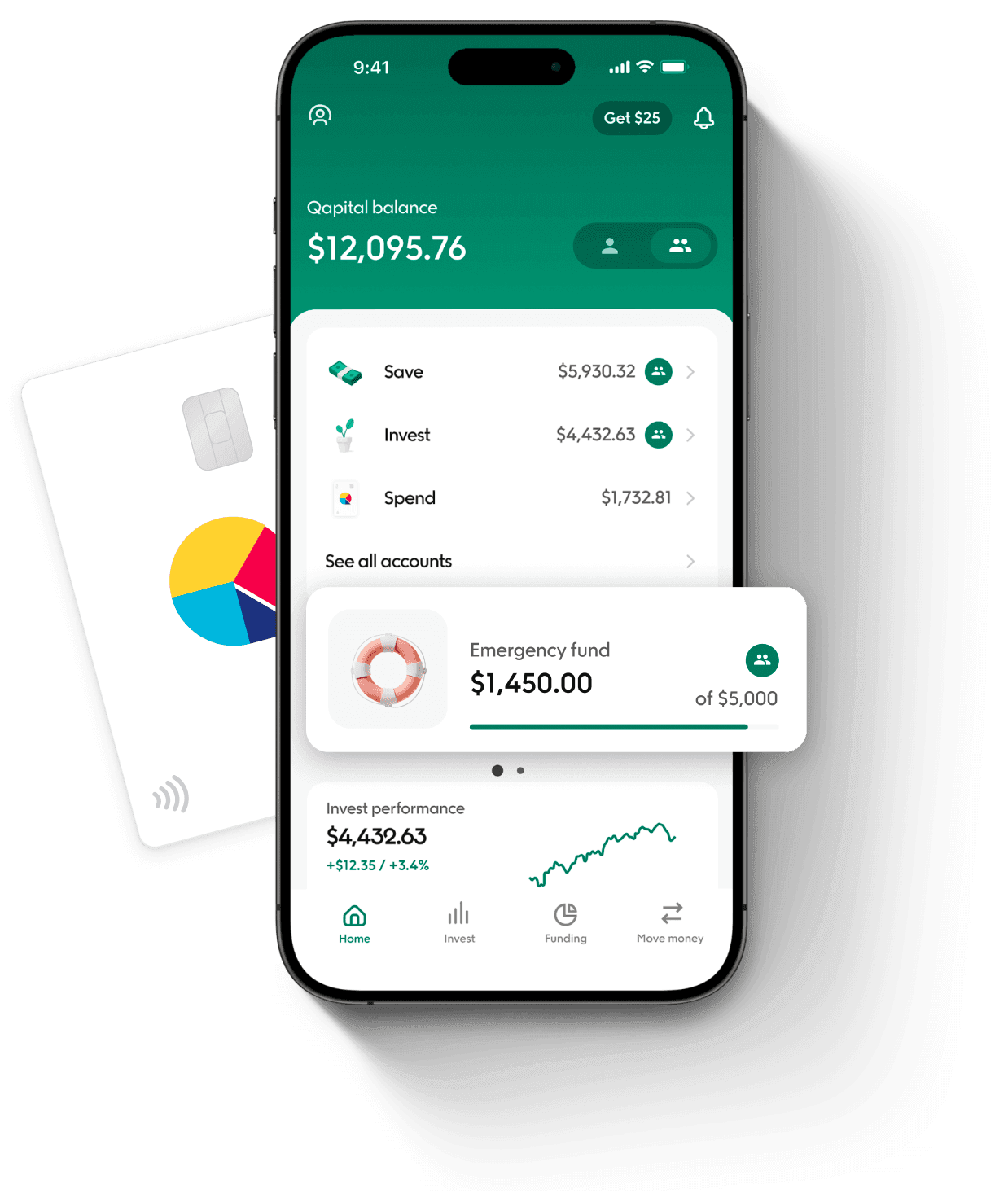

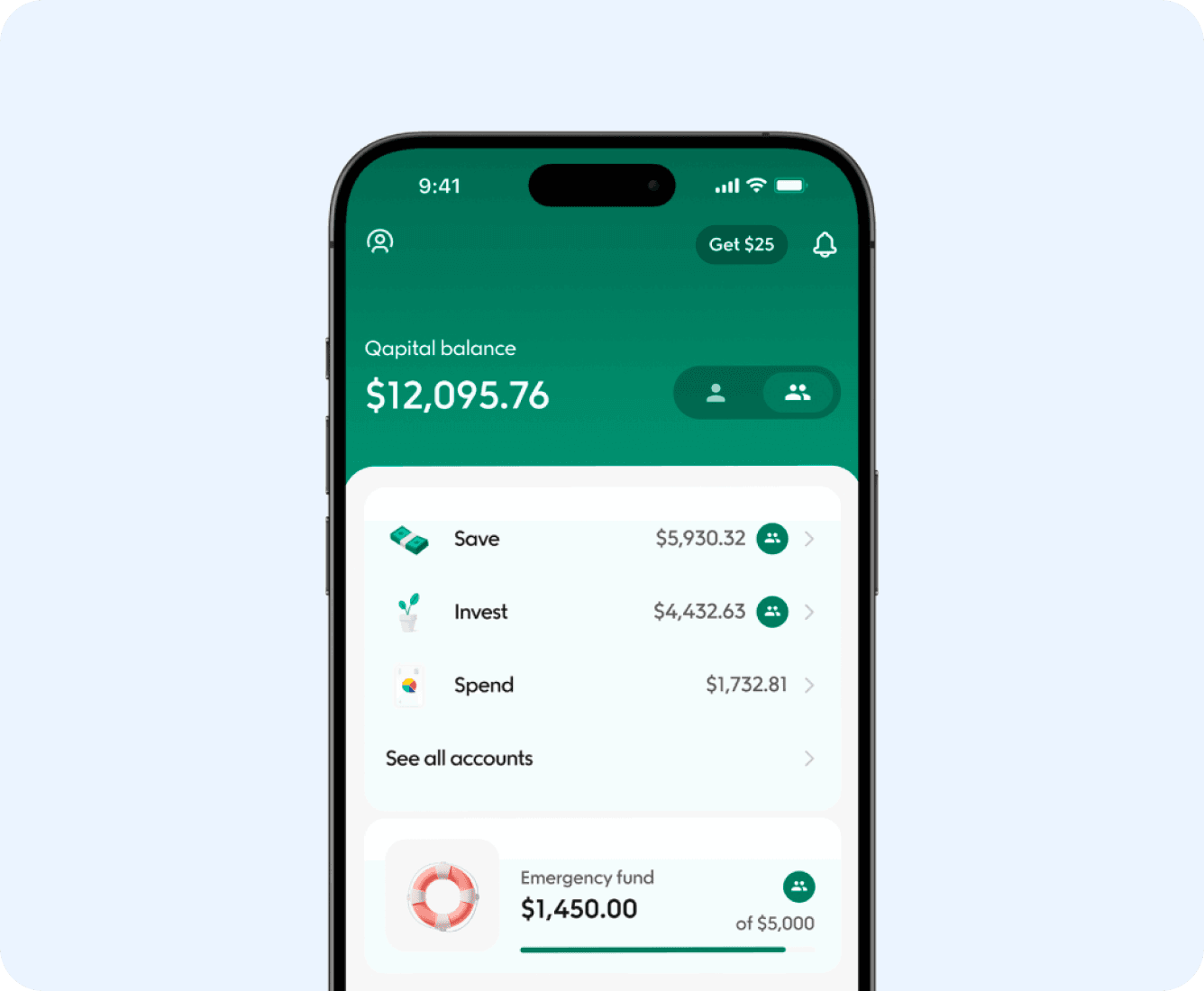

Once we understood the problem, we put together a team of product experts and finance pros to build a solution. The result is the Qapital app; a suite of set-and-forget money tools that make financial decision-making easier on the brain. At a time when nearly half of Americans don’t have even $1,000 on hand for emergencies,* Qapital has helped members save over $3,000,000,000 collectively.

*2023 Lending Tree Survey

2013

Founded

3.5m+

Downloads

$3B

Saved by our users

Born in Stockholm. Raised in New York City.

Qapital is a global, remote-first company with roots in both Stockholm, Sweden and New York, NY.

We’re changing the conversation about personal finance

Qapital has been making headlines since emerging on the scene in 2013.

Qapital “blends behavioral psychology with technology, allowing users to passively save and invest with customizable triggers.”

“A secret savings weapon — an app that does the work for [you].”

Qapital is for “anybody looking to make savings easier.”

“I don’t check the Qapital app often, so I hope to forget about my breakup fund until a post-breakup splurge reminds me that there is a piggy bank to be smashed.”

Rodrigo Parrode, CEO

“Qapital is a powerful tool for anyone who wants to improve their financial situation. It’s all about making that next step easy and intuitive for people, and setting them up for long term success.”

Meet the leadership team

We’re lead by experts in product, engineering and personal finance.

Rodrigo Parrode, CEO

With 25 years of experience in global financial markets, Rodrigo has learned the ins and outs of providing top-notch financial services. He now leverages that expertise to drive Qapital’s strategic vision and oversee daily operations.

Darwin Arifin, CPO

A trained scientist and engineer, and cofounder of a cross border US investing app, Darwin leads the product team and focuses on aligning the company’s product strategy with its business strategy.

Mark Barberan, COO

An expert at building strong partnerships with clients, vendors, and regulators, Mark is responsible for the company’s operational strategy, customer experience, information security, and risk functions.

Anders Blockmar, CTO

With 20 years of experience in back-end focused full-stack development and scalable cloud- based systems, Anders works to make sure that Qapital’s tech is customer-centric, highly scalable, and has bank-level security.

Samantha Kirkman, CFO

A credentialed accountant with nearly 20 years experience in the financial services industry, Samantha is responsible for managing and leading Qapital’s financial initiatives.

Cullen Rogers, CIO

With over a decade of experience in the venture capital and startup ecosystem, Cullen spearheads the integration of innovative financial technologies into personal investment strategies.

Matthew Bromberg, GC

Matt has spent 25 years as a financial services industry attorney, with global banks and investment advisers. Matt advises Qapital on day-to-day operations, including on commercial, compliance and regulatory matters.

Start your free trial

Qapital costs $0 for 30 days.* After that, it’s about the same price as a cup of coffee.