Qapital’s Halloween advice: Don’t make investment decisions based on fear

●29 Oct, 2020

Halloween is usually a fun kind of scary, but with next week’s presidential election on the horizon and a global pandemic still raging, you may find yourself actually feeling nervous this year – especially about your investments. We are certainly seeing a lot of stock market volatility, but don't let that mess with your investment strategy.

Whenever we need a dose of rational thinking we turn to our Chief Behavioral Economist Dan Ariely. In addition to being professor of psychology and behavioral economics at Duke University, Dan has played a key role in developing the saving and budgeting tools that have helped our members save more than $1B. So who better to drop a little wisdom when it comes to volatile markets?

Markets go up and markets go down. It’s true that the market could take a dive after the election. But day-to-day fluctuations are normal, and it’s best not to sweat them. We aren’t saying that you shouldn’t pay attention to the market; you’re an investor now, so it’s good to stay up to date on what’s happening. But it’s also important not to panic over changes in the value of your investments.

Don’t make decisions based on fear

Says Dan: “Every time you open your portfolio and you notice that the value’s changed, it’s going to impact how you feel.”

Sometimes, because they’re feeling emotional about the state of their portfolio, investors will take action. This might mean cashing out their stocks and investing in bonds, for example.

“Historically, those are some of the biggest mistakes that people can make,” says Dan. Don’t make market decisions when your head is clouded by emotions.

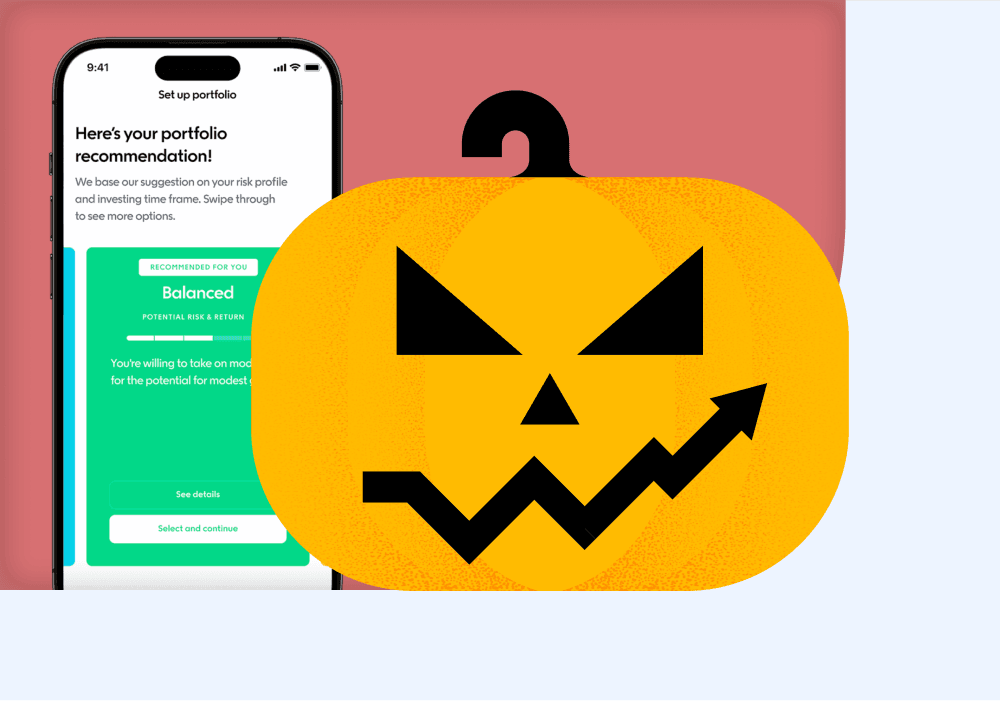

His recommendation is to act deliberately — rather than react to the state of your portfolio. Don’t even check your Invest balance unless you have a clear idea of what you want to do: “Decide what change you want to make, and only then open your portfolio. It’s never a good idea to open up your portfolio for fun and then decide what to do.”

Investing is a long-term game. Many of our members have Invest Goals for things like down payments, college funds, and retirement. If you plan to use the money you’ve invested years from now, then volatile markets this week shouldn’t be of much consequence to your long-term Goals.

You can set up a new Invest Goal in the Qapital app or simply convert one of your existing Savings Goals to an Invest Goal.

When evaluating the performance of your investments, an important benchmark index to watch is the S&P 500. The S&P 500 is a collection of the largest publicly traded companies in the United States. It’s called a ‘benchmark index’ because it gives you a good general understanding of what’s happening in the market.

The average return of the S&P 500 over the last 100 years is between 6% and 10%, depending on whether or not you reinvested dividends. Corrections and crashes happen, but the overall long-term trend of the market is that it goes up.

Remember that in times when temporary volatility can get you down.

Make ‘buy and hold’ your new money mantra, and keep working toward your Goals.

At Qapital we have built the most simple investment solution there is. Qapital Invest Goals take full advantage of Modern Portfolio Theory and all the rational tips that Dan preaches.

Learn more about Qapital Invest here.

Qapital, LLC is not a bank; banking services provided by Lincoln Savings Bank, Member FDIC, and other partner banks. Advisory services provided by Qapital Invest, LLC, an SEC-registered investment advisor. The information provided herein is for informational and general educational purposes only and is not investment or financial advice. Past performance is no guarantee of future results. Any historical returns or projections are hypothetical and may not reflect actual future performance. Investments in securities are not FDIC-insured and may lose value. This is not a complete description of Qapital Invest’s investment advisory services. For more details, click here. Brokerage services provided to Qapital Invest clients by Apex Clearing Corporation, an SEC-registered broker-dealer and member FINRA/SIPC. Copyright © 2023 Qapital, LLC - All rights reserved.

Share