Tax season is a stressful time — it’s complicated and full of uncertainty. This year, tax refunds are down about 17 percent, disappointing many Americans who were anticipating a large windfall of cash come early spring.

American employees are now getting a feel for what freelancers and small business owners experience. Because of their complicated tax situations, freelancers and small business owners typically pay taxes rather than get a refund.

Wanting to get a tax refund, instead of owing the IRS money, is actually irrational (as I explain below). But it is also very human. We like getting back money, even if it is our own. And having money in hand helps us plan better for the future. So, with this in mind, the question is how can we design a system to get back this windfall?

Create your own tax refund on your own terms

If you received a tax refund in the past, that means you essentially gave the U.S. government an interest-free loan until you filed your taxes for that year. It’s not the way a rational accountant would design the system, but we now understand that we get multiple benefits from this forced savings mechanism. When we get our tax refund we feel we have some unexpected money and we use it — many people use a third of their tax refund to pay off their debts, a third to splurge on themselves, and then put the rest into savings.

Now that we understand that it is useful to have a forced savings mechanism, why count on the IRS to provide it? Instead, wouldn’t we be better off creating a system of saving in a way that works for us?

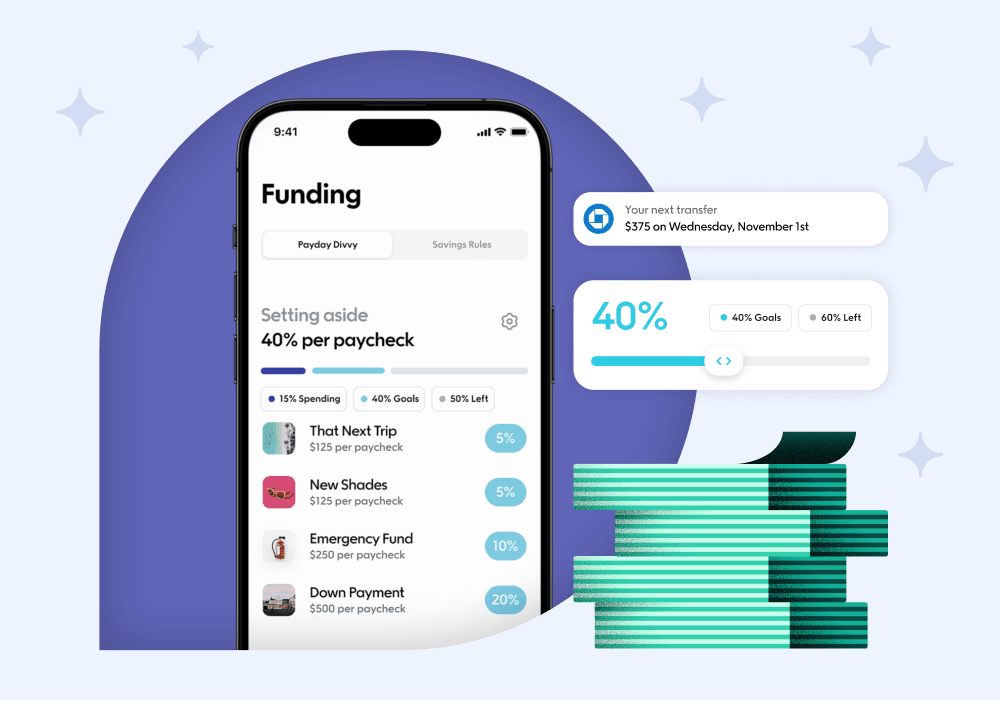

For example, if we were to create our own “tax refund” we might set it up to save 5 percent of every paycheck, $10 every week, or $5 whenever we dine out. We might increase it more in the month when we have low expenses and save more when energy bills are lower. And if we were to build the system ourselves we would probably not cash it out on April 15th. Maybe we would take half just in time for the holiday season, and the other half in the summer.

There are many ways we could design a financial system to deliver such a self-created tax refund, but at Qapital it has already been done for us. This approach of moving money automatically from one account to another and setting up saving goals is the basis of our system. And Qapital does it because splitting our money into different buckets and setting goals helps us to spend in a way that makes sense for us.

Take a little extra time to evaluate your finances

But, wait. There is more. As part of the tax process, people often review their personal finances closely. They check their credit card statements, bank statements, spending habits, and more. If you are already taking additional time to study your finances, why not spend some of that time adjusting your saving and spending habits so you’re more focused on your goals?

For example, take a look at some of the major categories of spending — credit cards, restaurants, education, travel — and honestly ask yourself if you are spending the amounts you spend out of habit or because it fits your current and future goals.

Here are a few recommended goals that we find many people benefit from — see if they could also work for you.

1) Pay off credit card debt

If you find that your credit card debt is higher than expected, set up a Goal to pay down that debt. You can open up a Credit Card Debt Goal on Qapital and set up Rules to move money toward paying off your credit card. You can even use the Round Up Rule linked directly to the credit card you are trying to pay off!

2) Create a rainy day fund

If you notice that you’re short on unexpected emergency funds, use the Set & Forget Rule to put a bit of money aside every time your checking balance is over a certain threshold. This way when the time comes (hopefully not!), you’re prepared.

3) Invest in yourself

Spending money on things that make us happy is a good thing. The problem is when we impulsively spend on things that we later regret. Set up a Goal with an inspiring cover photo for something you really want and start saving.

4) Set some long-term goals

For long-term goals, such as a down payment on a house, retirement, or your kid’s college education, we recommend starting Invest Goals. Then start moving money to these Goals, even if it is just a bit every payday. The secret to saving is starting early and doing it consistently.

5) Get on top of your taxes

Lastly, for freelancers or small business owners, take advantage of the Freelancer Rule. It puts ⅓ of every paycheck into a separate account so that when the time comes to pay taxes, you are ready.

Rethinking your finances

This tax season, we hope you’ll see things differently than you have in the past. We encourage you to create your own refund goals and start working to reward yourself with that vacation or gift, as well as investing in a future goal. A little more intention in your financial efforts can go a long way.

Put money in its place

Master your money with the app that makes it easy to divvy up every dollar so you can balance what you want with what you need.

Create account

Share