COVID19 Throwing Off Your Budget? Make Your IRS Stimulus Last Longer

Creating and sticking to a budget can be hard. During a pandemic, many of us are feeling overwhelming financial anxiety - adding to the stress of budgeting.

Qapital has stepped up with a simpler, more effective way to budget; one that's rooted in behavioral science.

Find your Spending Sweet Spot

Thinking of a budget as restrictive is the first step to making it feel restrictive. Recently, our Chief Behavioral Economist Dan Ariely spoke with Qapital users via Instagram about the financial implications of COVID19, stating “this is an opportunity to reexamine what are the things that give us joy." Then, take on the challenge to create a new sustainable budget.

A sustainable budget will comfortably pace how you spend your paycheck. This is opposed to an ineffective budget, that encourages you to overspend or underspend, thereby steering you away from the quality of life you want and holding you back from financial freedom.

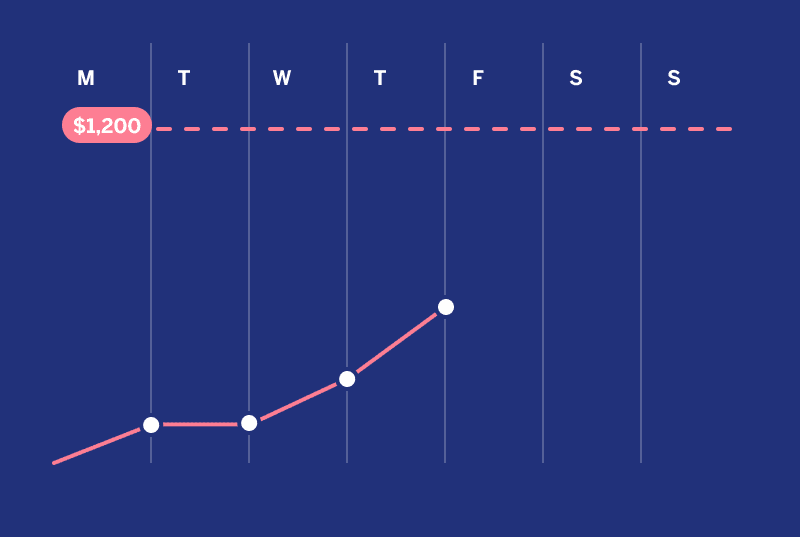

That’s why we designed our Spending Sweet Spot to let you customize a budget that fits your spending habits and income. It will automatically send you notifications that keep you updated throughout the week so you always know how you’re doing. You can adjust your budgeted amount at any time so you have the flexibility to learn and grow with your spending habits. You can also rate how your weekly spending made you feel and use that rating to adjust your weekly spending goal until you find the spending amount that makes you happiest -- your own Spending Sweet Spot.

Through use of the Spending Sweet Spot tool, included with your Qapital Complete and Qapital Master membership, you'll be able to build a balanced budget that finally gives you control of your finances - allowing you to make the most of your government stimulus payment, unemployment check, diminished salary, or any income.

We'll let Professor Dan Ariely delve deeper into the science behind this innovative budgeting tool.

Qapital: Should I split my budget by category?

Dan Ariely: “While it’s reasonable to have a budget for multiple categories, most people won’t stick to them. You don’t want to go for something that’s perfect, you want to go for something that is doable. For that, I recommend the strategy of creating one budget for all your discretionary spending.”

“Think about all the things you could live without. For example, grocery shopping is not one of those things. You can’t live without food. But take all the things you could live without, put them in one bucket, then think about what amount you want to spend on that category per week — coffee, drinks, going out, entertainment — and then think of that as a separate category, as a holistic category, without breaking it into components.”

Qapital: Should I create a weekly, monthly or yearly budget?

Dan Ariely: “If we have a yearly budget — let’s say $50,000 — we’ll run out of that money way too soon. A monthly budget makes sense for some things — it fits the bill of rent and so on — but most of our discretionary expenses* are either weekly or daily.”

“We certainly need a monthly budget for monthly expenses — rent and so on — but for discretionary spending*, it’s much much better to have a weekly budget. In fact, some studies show that even if you have a two-week budget, people spend way too much in the beginning and don’t have enough by the end. So if we want to spread our money correctly, the right framework is to think about a week.”

Qapital: When should the week start, for budgeting purposes?

Dan Ariely: “Should the week start on Friday or should the week start on Monday? Well, on the weekend we have more discretion. We can expand our spending [because] there are so many more things to do on the weekend. In fact, when you work, life is quite cheap; you don’t have enough time to spend all your money. But on the weekend, when you have more [free] time, you can expand your spending dramatically. It’s something to look forward to.”

“So what’s the right approach? If our week starts on Friday or Saturday, we end up spending way too much on the weekend and are left with no money by Wednesday or Thursday. But if we start on Monday we save some of the money because we want to keep it for the weekend, and then if we don’t have that much leftover it’s easy to shrink our amount spent over the weekend.”

The Spending Sweet Spot tool is available for users with a Qapital Visa® Debit Card. Sign up for a Complete or Master membership today to get a Qapital Spending Account and set a budget you can feel confident about.

GET STARTED >

This interview has been edited and condensed for clarity.

*Discretionary expenses/spending: non-essential purchases for things like leisure and entertainment.

The materials and content discussed in these sessions and on the Qapital app and website are opinions for informational and educational purposes only and are not intended to be tax, personal financial planning, investment or financial advice. Please consult a licensed qualified professional about your personal situation.

Share