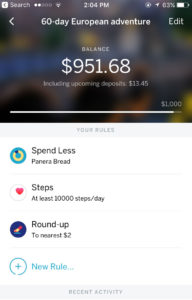

How I Saved $951.68 for my European Adventure with 2 minutes of Minimal Effort

Written by Lucy Ross, Editor in Chief at Likeabossgirls

You know that feeling on the first chilly day of the season when you reach into the pockets of the coat you haven’t worn in months and you realize you are now holding a $5 bill? Yeah, I don’t know about you but I get pretty jazzed about that. Fancy latte and a muffin, here I come!

So imagine that feeling times 200. Literally.

That’s how I felt when I went to check my Qapital app as I hopped on a plane to Budapest and found $951.68 saved and ready for spending on fun things. I had just set it up 6 months earlier!

LET’S START AT THE BEGINNING

Ok, let me explain. In August 2016 I decided I wanted to finally take this idea of a European springtime travel sesh out of my head and into action. I’m a digital nomad--a.k.a. I get to work from my laptop, so wherever I have a wifi connection and one of those aforementioned lattes, then I am good to go!

For me it was just a matter of logistics: where will I go, where will I live, and how long will I be there. And of course, intertwined with each question: how much moolah will I need to cover my expenses and then some.

I did some digging on this fantastic site where digital nomads rate cities based on different factors that affect our livelihood and quality of living called NomadList.com. I found that Budapest and Prague met my requirements:

- High-speed internet that is easily accessible (i.e., complimentary fast wifi at all cafes)

- Friendly toward foreigners

- At least of a third of the population knows English

- Safe for a solo lady traveller

- Low cost of living

BUDGETING FOR A TRIP

Once I nailed down the locations, it was on to planning out my finances. I calculated my average monthly expenses for the last year in the U.S. and then told myself Lucy, your monthly expenses for this 2 month European jaunt need to be equal or less than that!

So off I went finding airbnbs and flights that were in the budget. Easy enough.

But I know myself and know that if I have an opportunity to go to some cool cultural event (like the Hungarian Folk Dance concert I just went to last night) then I want to be able to go do those things guilt-free… “When in Rome...” right?!

I knew I wanted to set up a savings plan for the “little luxuries.” Within that day, I learned about Qapital (gotta love targeted Instagram posts!).

HELLO EASIEST SAVINGS APP EVER, NICE TO MEET YOU

The premise is simple: it’s too hard to save AFTER you’ve spent money. So why not just save while you spend. And make it automatic!

I downloaded the app and within 2 minutes I had set up rules for reaching my savings goal of $1000 (=$500 for each month I’m there) for the little luxuries of my 60-Day European Adventure.

I had 3 “rules” for saving that I set up in the app:

- A Round-Up Rule: Every time I made a purchase using one of my connected cards, Qapital would round up to the nearest second dollar and put that difference in my savings

- A Spend Less Rule: For every week I spent less than $15 at Panera Bread (where I have a bit of an addiction!), then the difference is saved in my account

- A Steps Rule: Every day I walked 10,000 steps or more, 5 buckaroonies get transferred to my savings (Yay health! Yay savings!).

Here are screenshots of the my rules and activity for a few days in March:

So that was August 19th when I set up those rules. On April 3rd, as I boarded the flight for my first leg of my journey, I wanted to see how my progress was looking (FYI, they also sent me monthly reports of how close I was to my goal so I could adjust or add rules whenever I wanted).

And what did just six-and-a-half months of mindless automatic saving have in store for my future little luxuries? $951.68! Not bad for a mere 2 minutes of effort setting up savings “rules” back in August! Concerts, fancy dinners, and facials, here I come!

I guess what I’m saying is two-fold: Saving is smart. But making saving AUTOMATIC is wise. Do both. It’s actually kinda fun.

Lucy Ross is a Web Design, Videographer & is the Editor In Chief at Likeabossgirls.

Put money in its place

Master your money with the app that makes it easy to divvy up every dollar so you can balance what you want with what you need.

Create account

Share