All articles

Spending Sweet Spot: Why a weekly spending target is the best budget to have

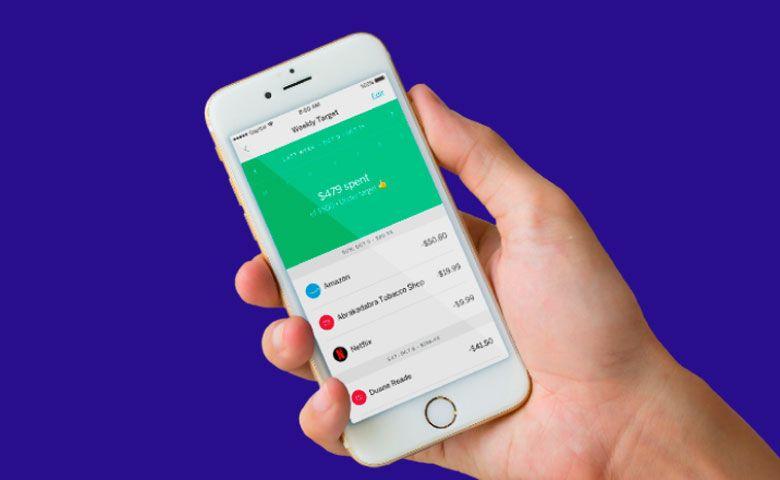

Creating and sticking to a budget can be hard. If you’ve ever felt too intimidated, too anxious, or too lazy to budget your money, you’re not alone. That’s why, with the help of Qapital’s behavioral economists, we designed a simpler, more effective way to budget. The results?

Spending Sweet Spot

Do you ever contemplate what you should spend instead of what you could spend on a regular basis? A sustainable budget will comfortably pace how you spend your paycheck. But ineffective budgets that encourage you to overspend (paying for unnecessary expenses) or underspend (limiting your ability to sustain the quality of life you want), hold you back from financial freedom. If you don’t feel balanced or in control, then you can’t be honest with yourself about your money.

That’s why we designed our Spending Sweet Spot to let you customize a budget that fits your spending habits and income. It will automatically send you notifications that keep you updated throughout the week so you always know how you’re doing. You can adjust your budgeted amount at any time so you have the flexibility to learn and grow with your spending habits. You can also rate how your weekly spending made you feel and use that rating to adjust your weekly spending goal until you find the spending amount that makes you happiest -- your own Spending Sweet Spot.

How are we so sure we’ve made smart spending easier? Because we asked our Chief Behavioral Economist, famed researcher and professor Dan Ariely. If you have budgeting questions, he has the answers — and we built our Spending Sweet Spot feature with those answers in mind.

Qapital: Why should a budget be weekly? Why not set it monthly or yearly?

Dan Ariely: “If we have a yearly budget — let’s say $50,000 — we’ll run out of that money way too soon. A monthly budget makes sense for some things — it fits the bill of rent and so on — but most of our discretionary expenses* are either weekly or daily.”

“We certainly need a monthly budget for monthly expenses — rent and so on — but for discretionary spending*, it’s much much better to have a weekly budget. In fact, some studies show that even if you have a two-week budget, people spend way too much in the beginning and don’t have enough by the end. So if we want to spread our money correctly, the right framework is to think about a week.”

Qapital: When should the week start?

Dan Ariely: “Should the week start on Friday or should the week start on Monday? Well, on the weekend we have more discretion. We can expand our spending [because] there are so many more things to do on the weekend. In fact, when you work, life is quite cheap; you don’t have enough time to spend all your money. But on the weekend, when you have more [free] time, you can expand your spending dramatically. It’s something to look forward to.”

“So what’s the right approach? If our week starts on Friday or Saturday, we end up spending way too much on the weekend and are left with no money by Wednesday or Thursday. But if we start on Monday we save some of the money because we want to keep it for the weekend, and then if we don’t have that much leftover it’s easy to shrink our amount spent over the weekend.”

Qapital: Should my budget have categories?

Dan Ariely: “The answer is yes only if you’re perfectly rational and if you enjoy budgeting. While it’s reasonable to have a budget for multiple categories, most people won’t stick to them. You don’t want to go for something that’s perfect, you want to go for something that is doable. For that, I recommend the strategy of creating one budget for all your discretionary spending.”

“Think about all the things you could live without. For example, grocery shopping is not one of those things. You can’t live without food. But take all the things you could live without, put them in one bucket, then think about what amount you want to spend on that category per week — coffee, drinks, going out, entertainment — and then think of that as a separate category, as a holistic category, without breaking it into components.”

The Spending Sweet Spot tool is available only for users with a Qapital Visa® Debit Card. Sign up for a Complete or Master membership today to get a Qapital Spending Account and set a budget you can feel confident about.

To find your Spending Sweet Spot, download the Qapital app today!

This interview has been edited and condensed for clarity.

*Discretionary expenses/spending: non-essential purchases for things like leisure and entertainment.

Share