All articles

A few years ago I decided to manage my money with Qapital. Not only has it helped me keep track of where my money goes, but I’ve also led a richer life. In turn, I’m a happier, more fulfilled me.

What’s cool about Qapital is that it’s a one-stop shop to make purchases, track your spending, and save for goals — without having to step foot inside a brick-and-mortar bank. That’s right, all you need is a handy app.

Using Qapital has helped enrich my money life and taught me a lot. Here’s what I’ve learned:

Systems override habits

If you don’t want to gorge on peanut butter cups, you shouldn’t have them lying around in the kitchen. The same “you can’t eat it if you don’t see it” principle goes for your money. If you want to save your beans, you should silo away those funds.

I don’t always trust myself to do the best thing with my money, but I do trust the system I’ve created. A big part of that is auto-saving and setting up fun rules for different saving goals I’ve set up through Qapital.

Right now I’ve set up auto-save plus a mix of rules for an art project, a vacation with my partner to Vietnam, and a big blowout for my mom’s milestone birthday. And I just started a few goals to give back in my own way.

Knowing I’ve got my saving goals on cruise control allows me to spend more freely, without guilt or worry that I’m not keeping my other money goals in mind.

And while being aware of my money habits is key to changing them for the better, I don’t have to beat myself up over the fact that I’m not perfect with my money today. (But who is, really?) I know the system and rules I’ve put in place with Qapital keep me in check.

The less work you do, the more brain space you clear

While it’s hard to pinpoint the exact number, research suggests we make an average of 35,000 decisions in a given day. That breaks down to 2,000 decisions per hour, or one decision every two seconds.

For me, the trouble of making a decision is often harder than actually doing what I’ve decided. For instance, trying to figure out when I should go to yoga during the week is much harder than actually going once I’ve decided on set times. Less decision-making, less fretting.

And instead of quibbling over whether I should save that five bucks for later or spend it now, I’ve already committed to saving part of my paycheck through auto saving. I stress less, worry less, and clear my brain space for other matters.

You can balance present happy you with future happy you

A major turnoff with super money nerds is that they are depicted as never having any fun with their money. Because they aren’t into spending, they live deprived existences, devoid of a modicum of enjoyment.

It’s quite the opposite. Last I checked, spending your whole paycheck and being stressed about your money isn’t exactly a fun time either. That’s why it’s important to strike a balance. Sure, you want to save for goals in both the short and long term, but what about enjoying life in the here and now?

Because I pay myself first, and make a point to save for important, meaningful goals that will make my life richer, I can balance present happy me with future happy me. As long as I’m spending within the means I’ve safely set aside, I can feel secure about my long-term needs and have more fun today.

Being in control of your finances doesn’t have to be complicated

Being on top of your money game isn’t about numbers, math or following a bunch of rules. It’s about drumming up a sound, realistic plan, executing that plan, and in turn, dominating your finances. With that comes this blissed-out feeling of autonomy and having greater options.

Because to me, financial wellness is about the power of choice. If I want to quit the nine-to-five and pursue freelance, go on an impromptu weekend road trip without second-thoughts, explore off-kilter projects and take greater risks, I’m setting myself up to have that flexibility.

It boils down to making decisions you feel good about. That weekend binger you spent a quarter of your paycheck on that you couldn’t afford? That feels godawful. But the weekend binger you saved up for and pulled money from your designated “splurge fund”? That feels pretty awesome.

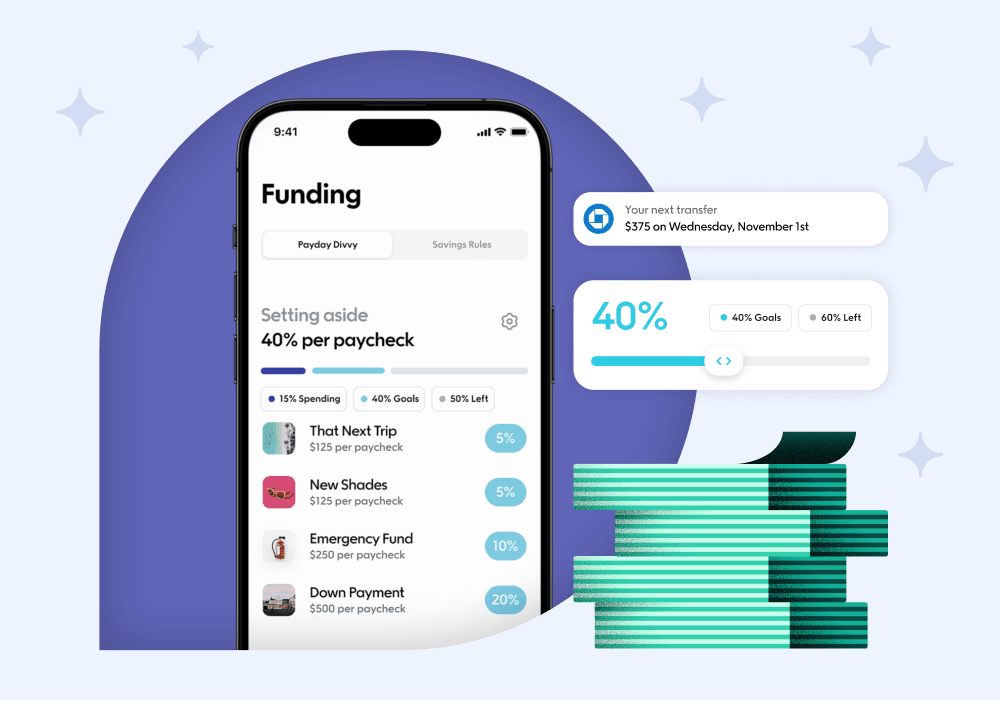

With Qapital’s Payday Divvy, I can set aside income for bills, my car payment, insurance, and a few savings goals. After I’ve allocated set amounts for my bills and savings, I can safely spend the rest on fun experiences and stuff that brings me joy in the present.

Greater self-knowledge leads to more feel-good vibes

Here’s how I use Qapital: I pay all my usual bills out of my “main account” and transfer a set amount to my Qapital account for discretionary spending. That’s everything outside of bills — groceries, eating out, entertainment, clothing, personal items, and so forth.

Separating my variable spending from my fixed expenses helps me see where my money goes each month. Plus, after doing some quick math, I know how much I have left to spend for the week. If I had a few spend-happy days, I know I need to scale it back to get back on track.

Another cool feature I’m itching to check out: Qapital’s Spending Sweet Spot. Up to now, I was manually doing simple math to figure out how much I had left to spend that week and how much I needed for discretionary spending.

Qapital’s Spending Sweet Spot takes out the guesswork. It helps you monitor how much you spend day-to-day on those lattes, meals out with friends, and so forth. (This is spending separate from your fixed expenses, such as rent or cable.) Because you know how much you’re spending, you can treat yourself without feeling guilty or remorse for overdoing it.

Having greater self-knowledge helps you make better decisions for yourself. You’ll know how much to set aside for your discretionary spending. It makes spending and managing your finances fun, easy, and empowering.

It’s funny how a seemingly simple decision such as signing up with Qapital can improve how you feel about your money. It also helps you not only feel happier and more fulfilled about your financial picture, but about your life in general.

Start a new financial relationship today. Get the Qapital app here.

Share